Stock Winners And Losers

Although we are not out of the woods yet and despite the uncertainty of the second wave that’s upon us, many companies have rocketed back from their mid-march lows making investment opportunities from the coronavirus sell off harder to find. Some companies were completely untouchable during this crisis and weathered the storm and made new highs. Of course, big tech was the winner during this crisis with names like Microsoft, Apple and Amazon getting everyone’s attention.

Cash Crunch Risk

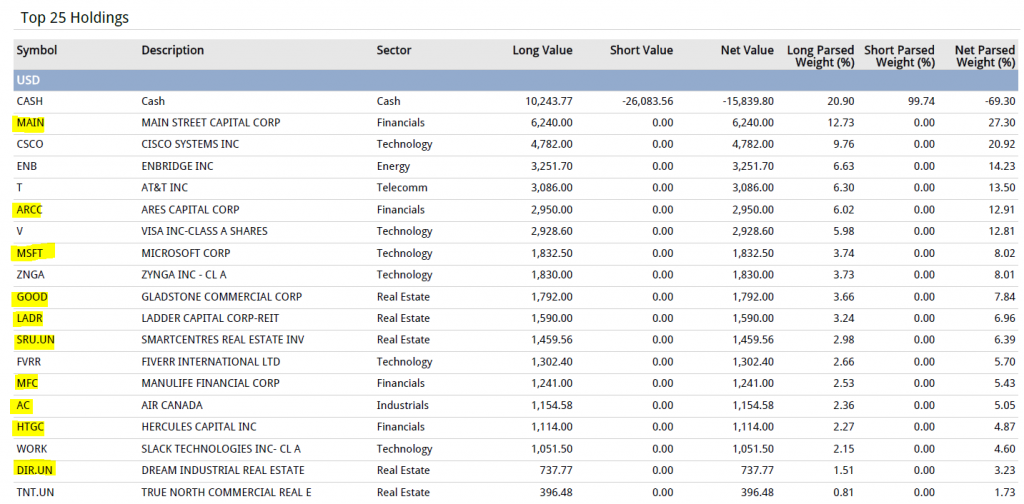

As mentioned in my video during the height of the crisis, the best companies to buy were cash rich tech conglomerates. Anytime there is a major selloff like this, there is a lot of irrational selling that takes place and the technology sector was no exception. It wasn’t the only buying opportunity but I loaded up on Visa, Cisco and Microsoft first because I had to be selective since I could’t buy everything that went on sale. In an environment where cash is king and debt is the enemy, the safest place to put your money were in companies that had no risk of getting into a cash crunch.

New additions to my portfolio

Since an opportunity like this comes along once a decade, I didn’t want to just stop at big tech. I also, had my eyes on BDC’s. Specifically Main Street Capital(MAIN) and Ares Capital(ARCC). Two of my favorite top tier lenders. There’s a lot of things to consider when assessing the risk of BDC’s but with both of these companies having first-lien loans making up the majority of their loan portfolio, diversified industry exposure, conservative leverage levels, they remain at the top of my list. Having exposure to any company in this business was not without significant risk. Being aware of this, I did not buy the underlying stock but instead bought options(I almost NEVER do this). With the dividend yield north of 15%, this was an opportunity that I did not want to pass up so I bought the option to buy 200 shares of MAIN at $20/share and 200 shares of ARCC at $9/share that I exercised last week.

If you blinked, you missed a lot of golden opportunities so where should we be looking now? There were many names I wanted to own before the crisis hit but the premiums people were paying were too rich and there was no value. I jumped on the opportunity to buy Microsoft and Visa but that window closed pretty quick.

So where are the new opportunities now?

The only place I would put new money into are cruise ships and airlines. Remember, just because you are buying shares at a fraction of what they were a few months ago, doesn’t always mean you are getting good value. Maybe mr market is right about pricing some of these stocks and the slashed share price is warranted. As always, I go with the best of breed in the industry so Carnival(CCL) is my top choice for the cruise ships and Delta(DAL) is my top choice for US airlines. The high levels of debt these companies took on and the cash burn rate is not to be ignored and time will tell how long it will last. Nobody knows the answer to this and if they did, the market wouldn’t give away great companies at such a discount. In my opinion, the potential reward outweighs the risk so its worth parking your money into these names.

Recent Comments