Current Market Conditions

Right now, the market is banking on a vaccine so we can finally defeat this virus once and for all. Some companies are relying on it more than others and their solvency depends on it. Specifically, airlines and cruise ships have been all the talk. Given the capital intensive nature of their business and being directly impacted by travel restrictions, it really is the perfect storm for companies like Delta Airlines(DAL) and Carnival Cruise Line(CCL).

Admittingly, 5 months ago I thought these were good value plays and I underestimated the long term damage this would have on these companies. Regarding Carnival, the coronavirus impact has added a whopping $7 BILLION of new debt to their balance sheet with a $650 MILLION monthly cash burn rate as I write this. Even if we come out of this tomorrow, most of the money they make will be used to pay creditors and NOT shareholders so I decided to pass on Carnival.

All Eyes On Tech Stocks

Then we have the technology sector. A sector that has been laughing during this whole pandemic. Luckily for companies like Microsoft and Google, they don’t need to take on debt to finance their operations. I didn’t really have a lot of weight in tech stocks before the pandemic because I thought they were way overvalued and I was patiently waiting for a buying opportunity.

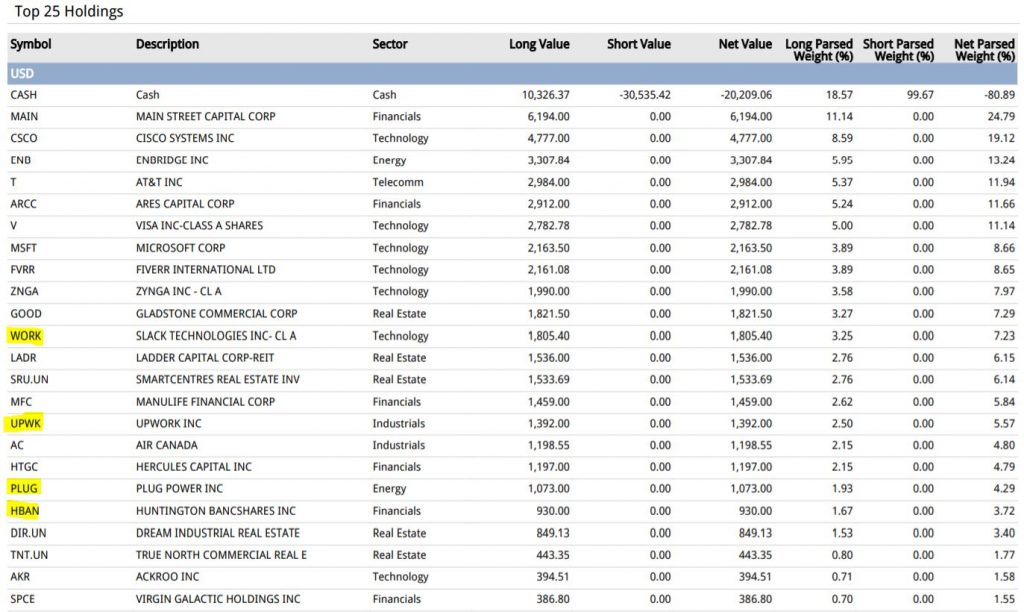

So at the height of the crisis, I loaded up on Microsoft(MSFT) and Visa(V), held on to Fiverr(FVRR) and Zynga(ZNGA), and took a new position in UpWork(UPWK), Slack(WORK) and Plug Power(PLUG). PLUG is technically not a tech stock but I really believe in their growth story.

Why Microsoft Over The Other Tech Giants?

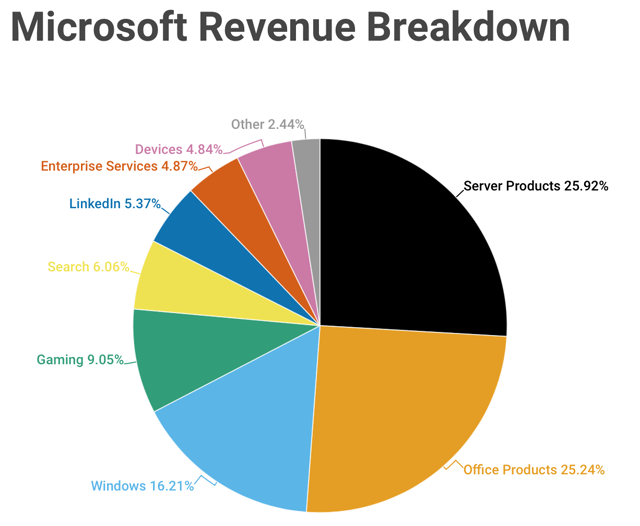

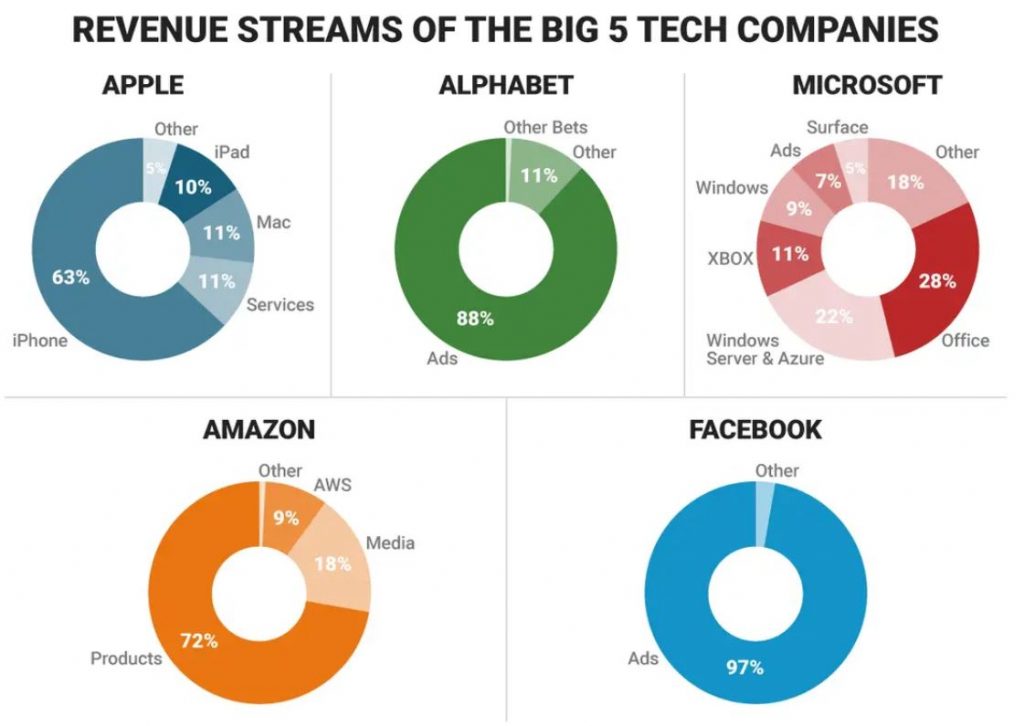

Whenever I invest in any company, I put having a strong business moat at the top of my list and Microsoft is no exception. Ever since computers became a common household item, a windows operating system to run it became the standard along with all of their products that come with it. This is Microsofts biggest weapon and they’ve used it to put many companies out of business. Remember Netscape? Probably not. But its not just their strong moat that attracts me as an investor. They are also the most diversified than the other big tech companies.

As you can see, they’ve come along way since personal computers were taking the world by storm in the 1980’s. They have revenue being generated from many sources. This is what truly makes Microsoft untouchable today.

Here is a visual to show you how they stack up against other well-known tech firms. The only company that comes close is Apple. My issue with them is that they are all within the Apple ecosystem. Yes, it’s a very strong ecosystem with loyal users but even though the odds of people breaking out of that ecosystem in waves is very unlikely, its not impossible. So I sleep a little better at night holding Microsoft.

Conclusion

Since this site is dedicated to dividend investing, it should be obvious that I love dividend stocks. I hold a lot of them and have no intention to ever sell them but in this environment, this new era, I want exposure to tech. I am more than happy to sacrifice receiving dividends for explosive capital gains.

Sometimes it’s easy to get tied to dividends because psychologically, it feels good watching those dividend payments come in. Although buybacks aren’t as visible and less consistent, I’m just as happy to see companies return money to shareholders in that form as well.

If a company is profitable, money being returned to shareholders is inevitable. With more than $300 Billion in cash sitting on Microsofts balance sheet, for them, I don’t see company buybacks slowing down anytime soon.

Recent Comments